Home Economics A Stronger Yuan Won’t Fix America’s Trade Deficits

A Stronger Yuan Won’t Fix America’s Trade Deficits

Anthony Tran • Posted 5 months ago

An ordinary person of humble background. In my salad days, I ventured into the sports journalism field, later navigating the fund industry, wielding the pen for investment, and eventually took on a research analyst role at a securities firm. Though being a Chartered Financial Analyst (CFA), studied cognitive science and journalism at university, and trained independently in triathlon and program trading, all these are but fleeting pursuits.

0

0

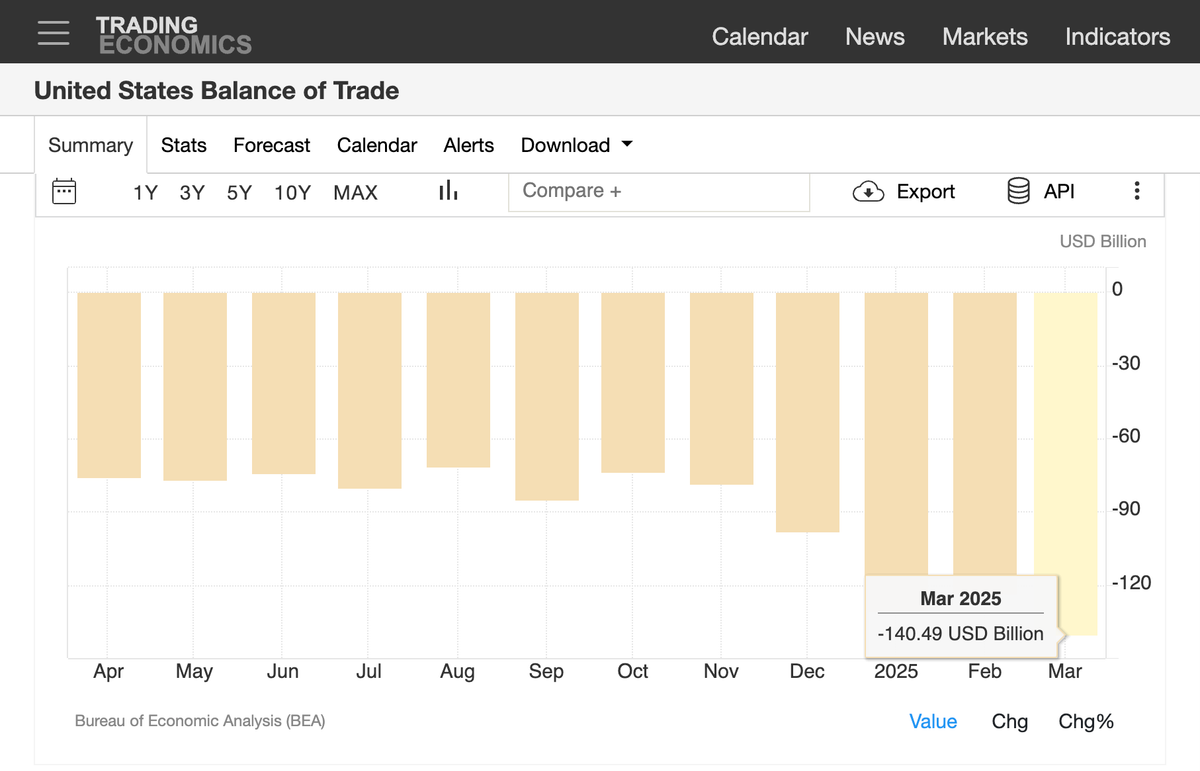

In politics, scapegoating is the go-to move to avoid voter backlash. The US, drowning in a record US$140.5 billion trade deficit in March 2025, per Trading Economics, needs a villain. Forget blaming America’s sluggish productivity or sky-high wages—point the finger at China’s currency controls, and spun as "manipulation" for maximum effect. It’s an old trick, but it sells.

The Currency Manipulation Playbook

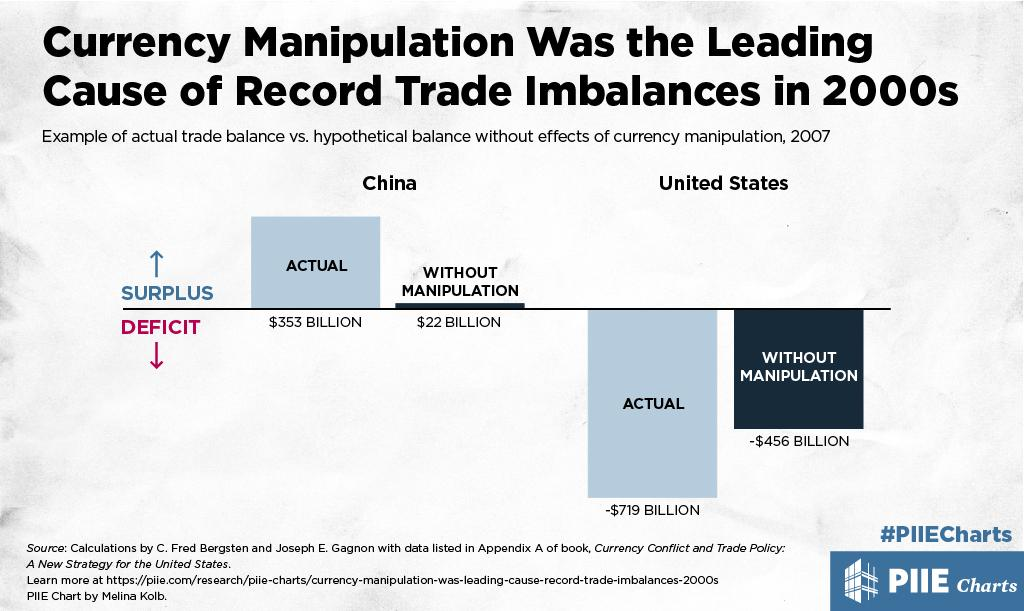

Since the 2000s, this story has been on repeat. The Peterson Institute for International Economics (PIIE) pegged China’s currency "manipulation" as a key driver of trade imbalances. In June 2017, PIIE Research showed that back in 2007, China’s trade surplus hit US$353 billion, largely due to an undervalued Yuan. Without it, the surplus would’ve been a measly US$22 billion.

Please upgrade to our premium member plan to read the full content

Upgrade Now0

0

Popular Tags

Popular Articles

Copyright ©2025 Fortress Hill Media limited. All rights reserved